Configure the authorize.net Payment Gateway

Authorize.net is a payment gateway service that enables customers to accept credit cards through websites. Users can transact and handle payments on a low-cost basis without paying any additional transaction fees.

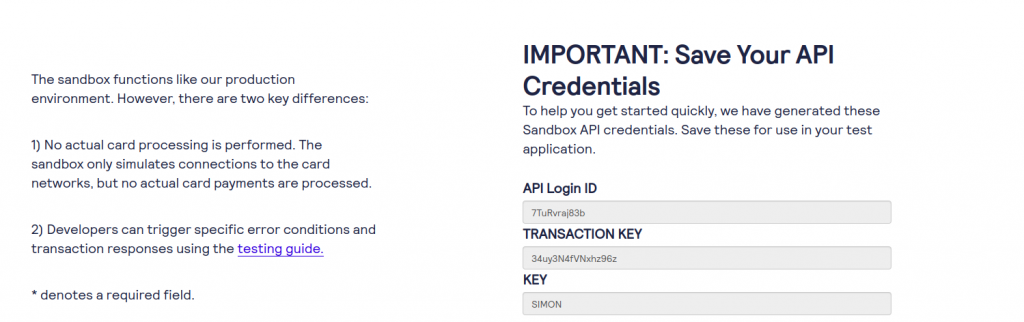

If you wish to check out the features of authorize.net, you can create a sandbox account (free service), it’s the same as a live (paid) account, and with the help of this application, we can validate all APIs and code before going to production.

Create Sandbox Account:

Open the Sandbox account sign-up page OR click this link https://developer.authorize.net/hello_world/sandbox.html

After successfully registering, we will get “API Login ID”, “TRANSACTION KEY” and “KEY”. But we can also change on per need basis.

Generate Transactions and Signature keys:

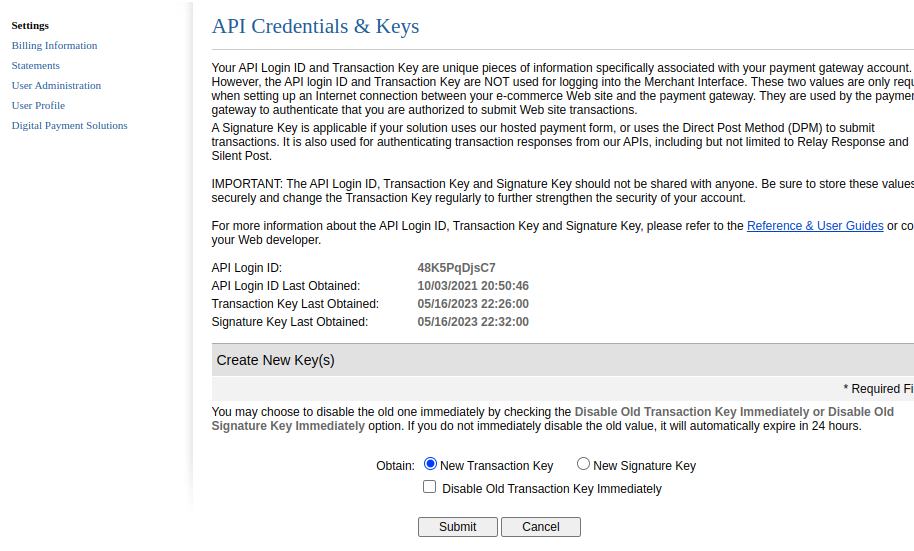

Open the Sandbox login page and enter login details. After successful login, click on the “Account” Menu, and on the “Account” page under the “Security Settings” section click “API Credentials & Keys”.

“API Credentials & Keys” page, we can generate the “Transaction key” and “Signature key”.

Configure Webhook Endpoints:

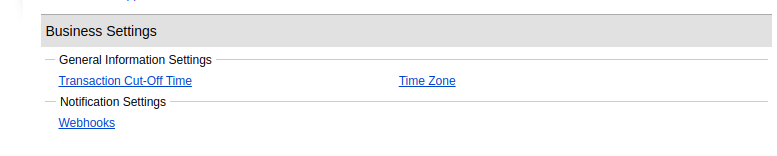

After creating the “Transaction key” and “Signature key”, we can configure Webhooks, by navigating “Account” and under “Business Settings” => “Notification settings” have the option “Webhooks“.

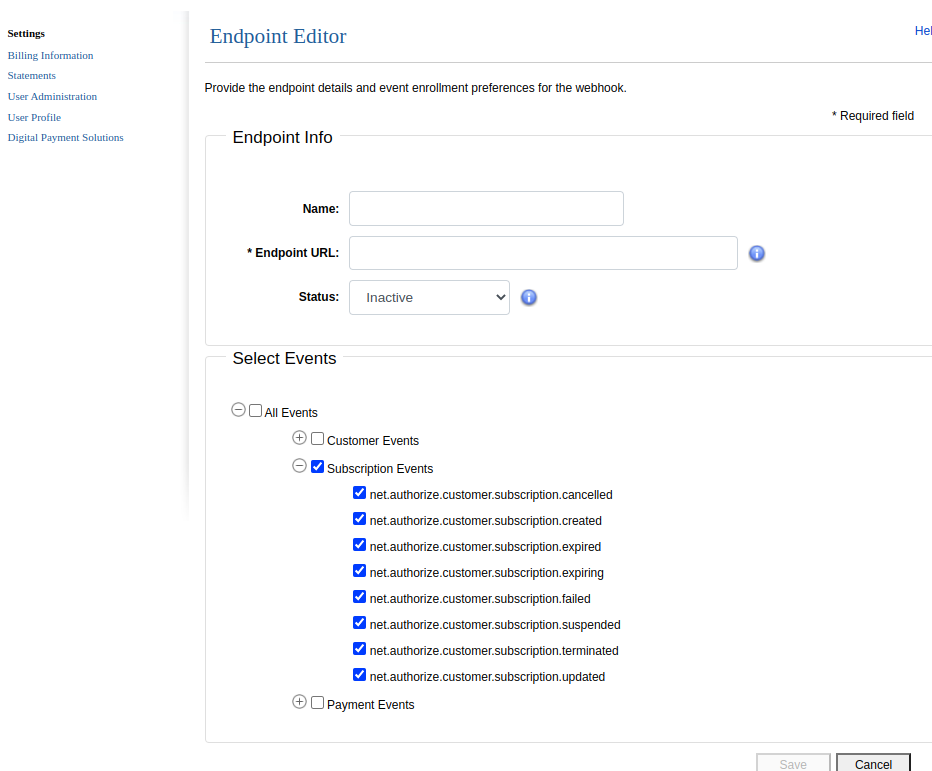

Click on the “Add EndPoint” button on the webhook page. Here Autherize.net provides three types of Events.

- Customer Event.

- Subscription Event.

- Payment Event.

We can add multiple webhooks depending on the requirement and for different types of events.

Note: Webhooks inform you of system events and should be used in conjunction with the reporting functionality of the Authorize.net API. We can update our database based on the Webhook response.

Payments:

The user can create Subscription-based payments as we well as one-time payments through autherized.net.

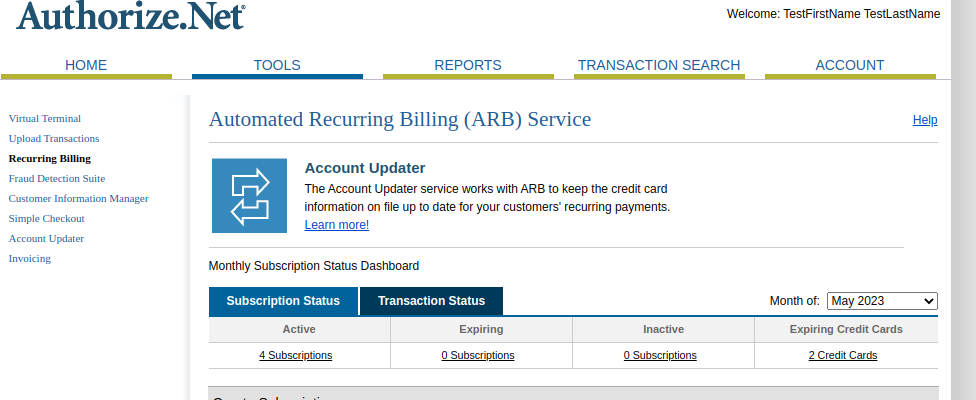

Show list of all subscriptions: After login, Authnet provides a “Recurring billing” link in the Left panel.

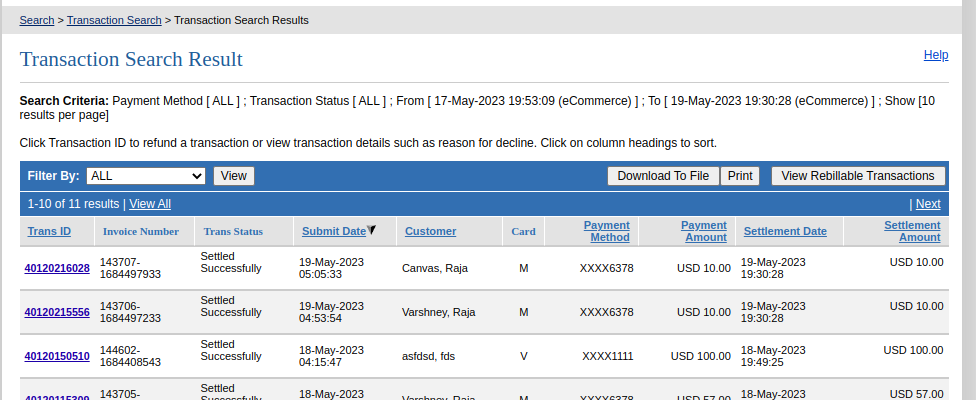

Search Transactions:

Click on “Transaction Search” in the main navigation and search for any transaction based on the use case.

Note: Subscriptions do not process transactions in real-time. Creating a subscription transaction successfully does not guarantee that subscription payments will process through your account successfully. Subscription transactions process at approximately 2:00 a.m. PST on scheduled payment dates. Therefore, the first scheduled transaction is not sent to the customer’s bank for authorization until approximately 2:00 a.m. PST on the start date that you specify when you create the subscription in your account. If you create a subscription with a start date that equals the creation date, the first scheduled payment does not process until after 2:00 a.m. the following day. If you wish to validate your customer’s payment information before creating their subscription in your account, use one of the real-time transaction processing methods available through the Authorize.net API.

API documentation:

Navigate to https://developer.authorize.net/api/reference/index.html, here we can find all API documentation. But before using this API, we have to set up “Autherize.net SDK” as per your programming language.

We can also download it from here: https://github.com/AuthorizeNet

Conclusion: With minimum transactions free authorize.net provides multiple types of payment services (single transaction, subscriptions) and accepts various types of credit cards, it has a large community and documentation available, and we can easily integrate it into our system.

If you still have any questions, leave a comment and join the discussion.