Analytics Use Cases that are redefining BFSI

Analytics Use Cases that are redefining BFSI

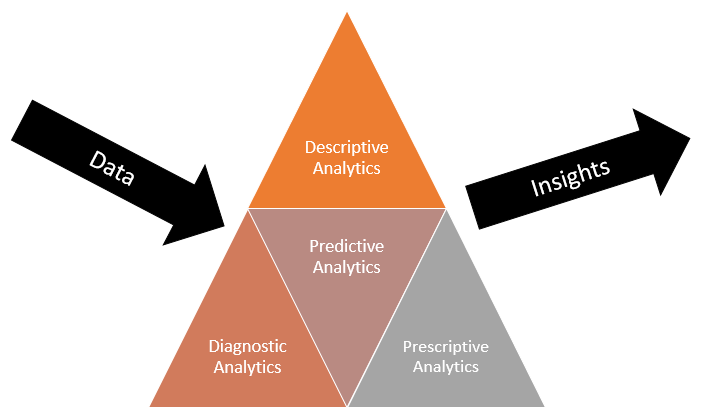

In today’s world, banking institutions have the benefit of redefining their products and services – with data and analytics. Decisions to redefine banking by driving profit and mitigating risks can be obtained from data. Using Analytics Banks are able to identify and understand consumer behaviour trends and provide better customer service. Analytics is comprised of 4 elements –

1. Descriptive Analytics

1. Descriptive Analytics

The main idea of this element is to identify and state the current situation through performance metrics, e.g. KPIs. Descriptive analytics help us answer the “What has happened?” question by executing data mining techniques on raw data

2. Diagnostic Analytics

This element attempts to understand the causes behind the current situation, if there is a correlation or causation between variables. For instance, current situation depict that credit card applications have increased. The next step is to ascertain if the credit card applications increased due to marketing investments, poor competitor credit card benefits, amongst others. Diagnostic analytics help us answer “Why is it happening?”

3. Predictive Analytics

Predictive analytics are based on factors influencing current and past situations. This element helps us have an estimate forecast for banking institutions to know where to place their resources. This element uses nuanced statistical model by identifying major variables, e.g. marketing investments, state of the economy and competitor analysis to help banks decide where to place their money at. Predictive analytics answers the question “What could happen?

4. Prescriptive Analytics

This element is based on the forecast mentioned above and is used to develop strategies for execution which would yield the best ROI. Prescriptive analytics answer the “What should we do?” question for better business engagement.

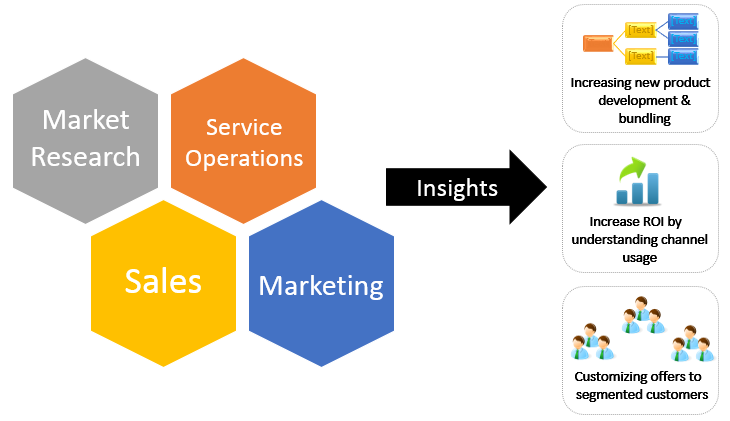

Popular Descriptive & Diagnostic Analytics Use Cases for Customer Analytics

Descriptive analytics studies raw data and are able to derive customer insights. Customer analytics can provide banks with good insights to banking channels to improve branch and online banking efficiency and efficacy. Descriptive & Diagnostic analytics can provide banks with

- Market Research (Consumer Behavior Insights, Market Basket Analysis, Persona Analysis for nuanced Segmentation & Targeting)

- Service Operations (Improving Service Operations & Complain Handling)

- Sales (Cross Selling & Up-Selling Opportunities, Customized Offerings)

- Marketing (Lead Generation, Sales Promotions, PR)

There are countless number of Analytics use cases specific to Digital Marketing as well. For example Banking Institutions can use Google Trends for a better understanding of current situations. Google Trends shows us the impact of a keyword relative to the total search volume across borders. Google Trends help us identify keywords and competitors when netizens search for a particular term. For instance, in October 2015, the term ‘fixed deposit’ was searched an average of 46,700 times in Malaysia. Additionally, netizens also searched for ‘Malaysia FD’, Best Deposit Rates’, ‘FD Calculator’, amongst others. By studying these trends and understanding competitors, banking institutions are able to tactfully derive insights and tailor their product and services with this information.

The above points demonstrate the role of analytics in redefining banking business intelligence. Following this, upon identifying these aspects, it is crucial that the execution phase is analytics-driven as well, and it is of equal importance that actionable strategies are deployed for improvement. The reality is that data is a BFSI institution’s most underutilized asset. Banks that pool their data sources to create depth and insights will find themselves on the forefront of new-age digital banking model.